Medicare Plans Connecticut

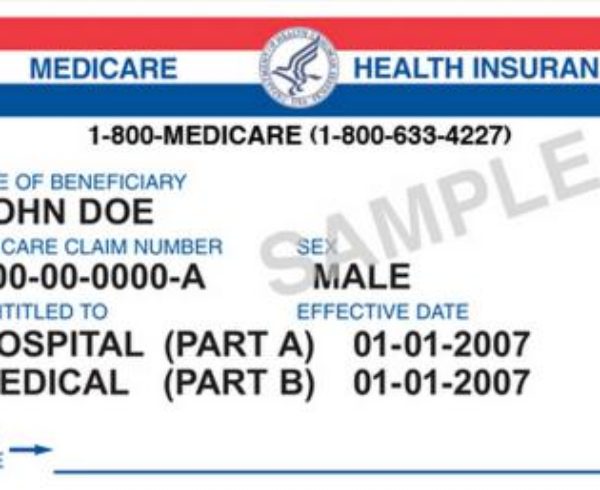

Medicare Plans Connecticut is a broad term that can refer to a number of companies or plan types in Connecticut. Insurance companies offer either Medicare Advantage plans (MAPD), Medicare Supplement plans (Also called Medigap) or Medicare Part D Rx plans. A summary of both plans and companies has been provided below. Choosing the right plan means matching up the needs of the insured (current health, doctors, as well as Medications and volume of care) with the strengths of the given plan type.

Medicare Advantage plans-

Managed Medicare plans offered with (MAPD) and without (MA) drug coverage. Medicare Advantage plans take the place of Original Medicare. They are the primary insurance and have a network as a result. There in network only (HMO) and out of network (PPO) plans available. In Connecticut, most plans are HMO style plans. Connecticare, United Healthcare, Aetna and Wellcare as well as Anthem BCBS offer plans in Connecticut.

There are two plans with a $0 monthly premium. Both require referrals to specialists. There are a number of plans in the $29 to $44 a month range. The higher end HMO and PPO plans have a premium from $99 to $128 a month. The positive points with MAPD plans are, they have a very low to no monthly premium. These plans include Medicare part D coverage and they offer some benefits that Original Medicare does not. Some of the negatives can be, the copay for medical services, provider networks as well as referrals for specialists. Click the links for plan designs of some of the more popular plans in CT.

Connecticut does not have medical underwriting which is important to consider. Medicare rules allow someone to change plans every January 1st during OEP. Without checking health, a member can change from a Medicare Supplement to a Medicare Advantage plan. If someone develops a health condition, they could change to a supplement without any issues.

Medicare Plans Connecticut

United Healthcare Medicare Complete Plan 1

United Healthcare Medicare Complete Plan 3

Aetna Medicare Plan HMO Connecticut

Medicare Plans Connecticut can also be Medicare Supplement Plans (Medigap)– Medicare Supplement plans are offered by a number of companies in CT. These plans are standardized. This means benefits are the same from company to company. Common plans offered in CT are Plans F, High F, N, K, L and G. AARP offered by United Healthcare tends to be the first choice in CT. A number of companies including Humana, AARP, Anthem BCBS, Combined Life, United American and Cigna all offer a number of plan choices.

Click here for standardized Medicare supplement rates in CT

Medicare Part D plans (stand alone Rx plans)- Medicare part D plans are offered by a number of companies in CT. Some of the more popular choices are UHC branded Saver, UHC branded Preferred RX, Humana Walmart Rx, Silver Scripts, Express Scripts Rx. There are too many plans to list them all. You cannot purchase a stand alone Rx plan with a Medicare Advantage plan. Clients can only purchase these plans along with a Medicare supplement. You can also combine these plans with Medicare A and B. If you buy a supplement plan, you do not have to use the same company for the Rx plan. Clients can choose any company they feel is offering the best plan for them. Note: The Humana Walmart Rx plan is the current lowest cost (lowest monthly premium) plan in CT.

States offer programs to individuals in need of assistance. In fact, you may qualify for assistance. Click here to learn about programs offered and determine if you are eligible.

Leave a Comment