Medicare Employer Information Form

Medicare Part A Coverage –

Are you working and Medicare eligible with insurance either through your own or your spouse’s employer? If this is the case, you should consider taking Medicare Part A (hospital Insurance). In most instances, there is no cost to you for the extra coverage Part A provides. We have included a link at the bottom of the page with the Medicare Employer Information Form. This form helps both you and your employer start your Medicare Part A coverage.

Should you take Medicare Part B coverage?

Before you sign up for Part B coverage there a few things you need to be aware of. First of all, Part B is medical insurance, this coverage is not free and you will be charged a monthly premium. You also need to know; when you are Medicare eligible your employer insurance may change to some extent. Check with your human resources department or benefit coordinator so they can explain any changes in coverage or concerns you have. You will also need to double check insurance information with the Social Security Administration and Medicare.

Health insurance is very important to us all. You don’t want to make mistakes with your healthcare coverage, as that could be costly. Each person has different needs, therefore it is entirely up to you to decide what coverage is best for you. You also have to decide if the costs will be reasonable with regard to your coverage needs.

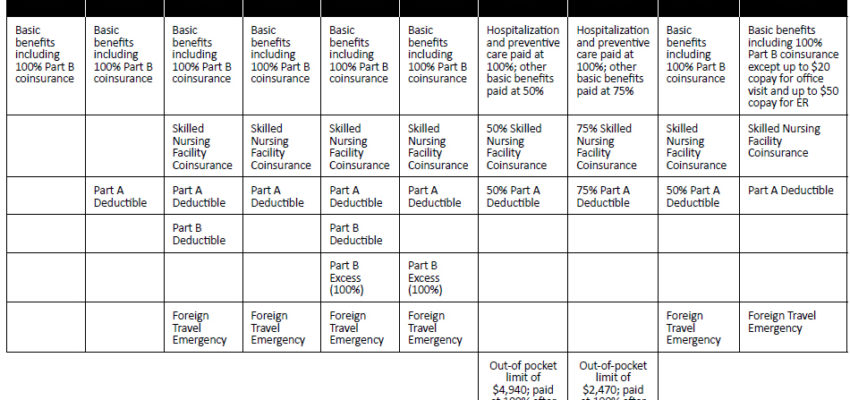

Primary and Secondary Insurance –

In fact, if you have primary insurance coverage with your employer, most likely you do not need Part B. If you are not satisfied with the coverage your employer provides, you may want to think about Part B coverage. If you choose to add Medicare Part B to your employer insurance you need to find out which insurance will be primary and which one secondary. Primary insurers will pay your approved medical claims first.

Secondary insurance will normally pay the part of your expenses left over after the primary has paid. The amount secondary insurers pay can be either all or some of the unpaid balance. This amount may be the remaining 20% of the doctors fee after primary has paid. If you are not enrolled in a primary insurance plan, but only a secondary plan, you will have little to no coverage. When employer insurance becomes secondary you may be better off if you take Medicare both Parts A and B.

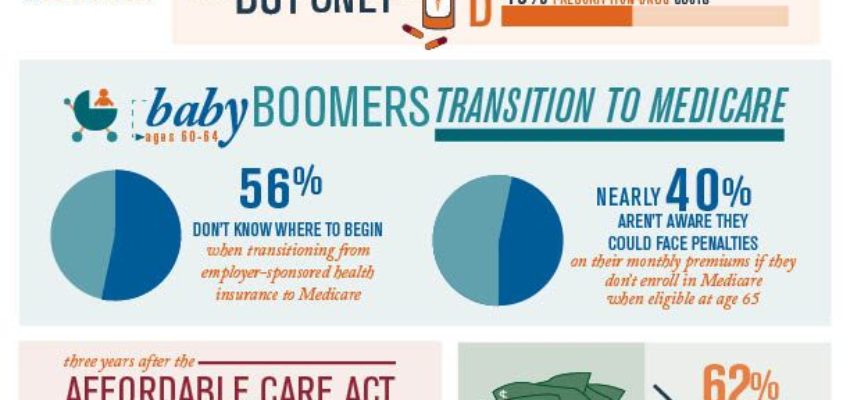

Enrollment Period

Medicare offers a Special Enrollment Period without penalty when you first qualify for coverage. You may enroll in Medicare, without penalty, at any time while you have group health coverage. This enrollment period is also good for eight months after you lose your group health coverage or you (or your spouse) stop working, whichever comes first.

Sometimes your employee coverage will automatically move into a Medicare Advantage Plan (private health plan). If you have health coverage from either a union, a current or a former employer when you become Medicare eligible. You can keep the Medicare Advantage Plan or switch to either Original Medicare or a different Medicare Advantage Plan. You should know that if you switch plans, Your employer or union could lessen or even terminate your health benefits or the benefits of your dependents. Discuss any healthcare plan changes you may want with your employer or union to make sure your coverage is safe.

Click the link below for the employer medicare Forms.

Recent Comments