Travel Benefits with Medicare Advantage

If there’s one thing that many people look forward to about retirement age, it is the opportunity to do things that their work lives made it difficult to do previously. For many, this means travel. As people age, however, their medical needs often become more complex. This means that it is necessary to think about medical benefits and how that coverage will be affected by travel. Here’s how travel benefits with Medicare Advantage can be affected by these situations:

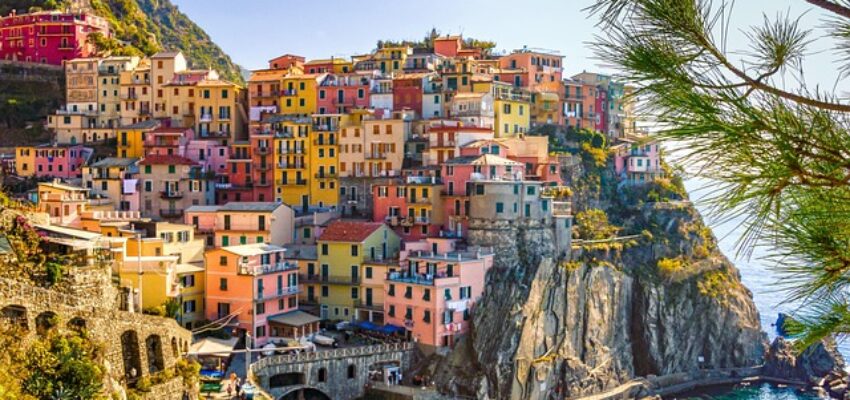

Travel Inside the United States

Original Medicare covers beneficiaries in all 50 states, and the United States’ territories such as Guam, Puerto Rico, American Samoa, and the Virgin Islands. Over 93% of doctors and hospitals in the U.S. and its surrounding territories participate in the Medicare program, and coverage is almost universal within the country because of it.

For Medicare Advantage plans, however, coverage is far more dependent on the insurance plan and carrier. There are some plans that do not cover any medical or healthcare services outside of their area. Some plans will cover services outside of the designated area and network, but with significantly higher co-pays and fees. There are also restrictions like prior-authorization to work around with some plans. However, the Medicare Advantage plans are required to cover emergency care anywhere in the United States.

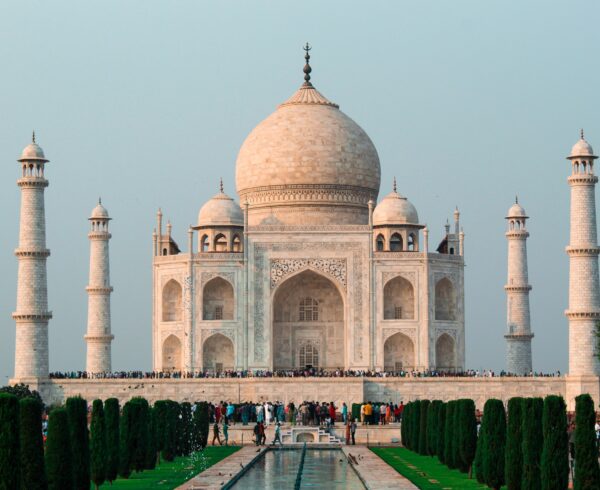

Travel Outside of the United States

There is far less coverage for beneficiaries if they are traveling outside of the country and its territories. For both Original Medicare and Medicare Advantage, there are very limited circumstances in which they will cover medical and healthcare services:

-

Medical services received in Canada while beneficiary is traveling between the continental U.S. and Alaska are covered.

-

Beneficiaries who receive care on a cruise ship will be covered if the ship is in U.S. territorial waters. That means within six hours of a United States port.

-

In very few situations, both Original Medicare and Medicare Advantage will cover hospital services if the hospital at which they were received was closer than a hospital in the United States. The most likely situation in which this could happen would be if the beneficiary is at the border of Canada or Mexico.

For beneficiaries about to embark on any journeys inside or outside of the United States, it is important to be aware of what their insurance will cover and what will cost them out of pocket.

Licensed Agents

Travel Benefits with Medicare Advantage is only one small piece of the picture.

Click here to see what Crowe and Associates has to offer

Keep up with all of our current events by clicking here.

Ready to contract? Begin here.

Subscribe to our YouTube channel. We provide weekly training.

Leave a Comment