Connecticut Medicare Plans 2017

The term “Connecticut Medicare Plans 2017” can mean different things. This blog will address the options a person aging into Medicare or already on Medicare will have in Connecticut for 2017. For additional information including signing up for Medicare A and B and rates, you can look at our other blog Medicare Plan Choices Connecticut 2017. We will focus on basic choices for Medicare eligible people in this post. The intent is to provide a general understanding of options available. Look to our other blog if you already know your choices and want more detail. Please email or call us with any questions at 203-796-5403 or email admin@croweandassociates.com.

There are three basic options or types of plans seniors typically use. The Medicare Supplements (also called Medigap) plans, Medicare Advantage plans (also called part C, Managed Medicare or Medicare replacement plans) and finally, there are Medicare part D plans (also called Medicare Rx/drug plans or stand along PDP plans). Medicare Advantage plans (MAPD) include a part D prescription drug benefit. Medicare Supplements (Med Supp) do not have drug coverage so you would need to buy a Medicare part D plan (PDP) if you want drug coverage.

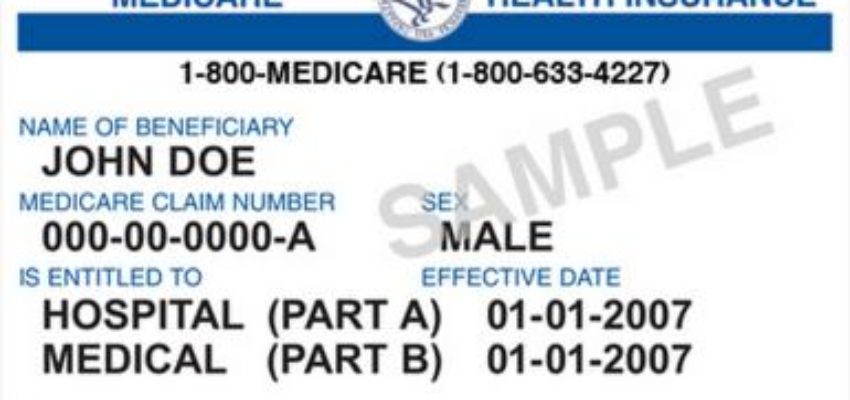

Original Medicare A and B

Connecticut Medicare plans 2017: First things first: In order to enroll in a Medicare Advantage plan or Medicare Supplement plan, you must have Original Medicare A and B. There are rules for eligibility and costs associates with Medicare A and B we will not get into detail about here. Use this link if you want to know the rules for enrolling and costs. Medicare A and B provides medical coverage on its own. It does not provide Rx coverage but does a good job on the medical side. It is feasable to have Medicare A and B only and then a PDP plan for those that want drug coverage. The only flaw with A and B on its own is the lack of an out of pocket max on the benefits.

Other than that, the 20% cost share is not as bad as it sounds due to the Medicare allowable cost amount the providers can bill. This just means Medicare controls how much you are billed for Medical services. Its hard to get a set number but they usually have a discount rate for charges between 50% to 75% depending the service.

Medicare Supplement/Medigap Plans

Connecticut Medicare Plans 2017: Many people choose to limit and/or cap the cost share they would pay being on Original Medicare. A Med Supp is a policy that covers some or all of the costs not covered by Medicare A and B. There are 11 different Med Supp plans. Each plan has a letter name that differentiates it from others. Companies offer plans A – N. Not all companies offer all plans. A Med Supp Plan A or B should not be confused with Medicare A and B. They are in no way related. A Med Supp A or B is just two of the 11 supplement options to choose from.

There are a number of plans that are “good deals” in Connecticut. Plans F,N,K, L and High F are available from companies at good prices in CT. Multiple companies offer supplements in CT. United Healthcare is the insurer of the branded supplement plans.

Contrary to the opinion of many,

There are NOT pre-existing condition clauses on Medicare supplements in CT if you have had any type of other coverage in the last 63 days. The only time there are pre existing conditions clauses is if someone did not have any other type of coverage for 63 days and then tries to sign up for a supplement. Some states do allow pre-existing conditions clauses even if there was other coverage in place but Connecticut (and NY for that matter) is not one of them.

The other important thing to note in CT is a person can change from one Medicare Supplement plan to another the first of any month. This is not the case in some states. It is possible in CT. CT is a guaranteed issue state. Also note: If someone is under the age of 65, they do not have access to all the plans. In most cases, clients under the age of 65 are limited to plans A-C.

Medicare Part D Rx Plans (PDP)

Connecticut Medicare plans 2017: PDP plans are stand alone drug plans offered by insurance companies. Medicare does not offer a plan but instead determine what the standard benefit model should look like. Click here for the standard part D benefit parameters. Various companies offer stand alone part D plans including United Healthcare, Aetna, Wellcare, Humana, Envison, Silverscript to mention a few. They all have different benefits and prices but work in a similar manner. Be sure to use a plan that has your drugs in the formulary and also has your pharmacy in network. Some plans will have preferred vs. non preferred pharmacies. It may not be obvious which pharmacies are preferred for your plan. Be sure to use a preferred pharmacy as your copays for the medications will likely be lower there.

Please note: you cannot have a stand alone part D plan and a Medicare Advantage plan at the same time. Enrolling in one will disenroll (kick you out) of the other. The only exception to this is if you have a Medicare Advantage plan called a PFFS plan. They do allow someone to enroll in a PDP at the same time.

Medicare Advantage Plans

A Medicare Advantage Plan, also known as Medicare Part C, Medicare replacement or a Managed Medicare Plan, plans offered by private insurance companies. They often combine medical and drug coverage. While they are not group health plans, they do work in a similar manner. Members pay copays for medical services they recieve. Different services have different copays such as a copay for a primary doctor and a higher copay a specialist doctor. Copays vary from company to company and plan to plan. Most advantage plans offer a part D drug benefit which works similar to a stand alone part D drug plan. Some plans require referrals for specialists while others do not.

Not all HMO plans require referrals but they do require members to stay in network for most services. Advantage plans may cover benefits not covered by Original Medicare and/or a Medicare supplement plan. Benefits and value added services such as dental, vision, Telemedicine, Silver Sneakers , OTC benefits and other programs.

Types of Medicare Advantage Plans

- Health Maintenance Organization (HMO) Plans

- Preferred Provider Organization (PPO) Plans

- Private Fee-for-Service (PFFS) Plans

- Special Needs Plans (SNP)

People are able to change a Medicare plan during Open enrollment. Open enrollment runs from Oct 1 to Dec 7th every year. They can make any changes they want for a Jan 1 start date. Please note: In states that allow underwriting, the member will be subject to medical underwriting if moving to a Medicare Supplement plan. There are additional periods when you can make plan changes such as the MADP, SEP’s and if there is a Trial Right.

Call or email us with any questions regarding this Connecticut Medicare plans 2017 blog. We are able to quote plans options and provide advice at no charge to you. Independent brokers receive commission pay from the insurance companies. You can contact the office either by phone at 203-796-5403 or by email to Edward@croweandassociates.com

Recent Comments