Medicare Supplement (Medigap) insurance is one of many great products for Medicare agents to offer their clients. They continue to provide a good source of income to agents with their stable commission structure and renewal income. The Medicare Supplement commissions 2025 remain the same as they have been in prior years. We will explain what to expect regarding payment of these commissions below.

How Medicare Supplement Commissions Work

Medigap commissions are structured differently than Medicare Advantage (MA) or Part D plans. Instead of receiving a one-time upfront payment, Medigap agents typically earn level commissions over multiple years. Here’s an overview of the commission structure:

- Initial Year Commission – Agents earn a commission based on a percentage of the first-year premium, typically between 20 and 22%.

- Renewal Commissions – In most cases, Medigap policies pay renewal commissions for a period of 6 years.

- Varying Payouts by State – Some states and carriers impose limits on commission percentages, affecting how much agents can earn.

How Agents Receive Medicare Supplement Commissions

Agents typically receive their commissions through one of the following methods:

Direct Deposit – Most carriers pay commissions electronically on a monthly or biweekly basis.

Advanced Commissions – Some insurers offer advance payments of commissions (e.g., 9 or 12 months upfront) based on projected renewals.

As-Earned Commissions – Commissions are paid out as the policyholder pays their premium.

General Payment Structure

A typical Medigap commission structure follows this breakdown:

First-Year Commission: about 21% – 22% of the annual premium

Renewal Commission (Years 2-6): percentage rates vary by area and carrier.

Payment Frequency: Monthly, biweekly, or advanced lump sums based on carrier agreements

Learn more about commission payment structures

Factors That Influence Commission Rates

Several factors determine how much an agent earns from selling a Medigap policy. These factors include; carrier-specific rates; each carrier sets its own commission structure (unlike PDP & MA/MAPD plans). Each state has its own regulations; some have specific commission caps (CA & FL). In other instances, commission rates are based on age of enrollee and plan type.

Medicare Supplement vs. Medicare Advantage Commissions

Medicare Supplement commissions are generally lower in the first year compared to Medicare Advantage, but the long-term renewal structure and coverage type make them more sustainable. Medigap policies also tend to have lower attrition rates, meaning agents can build a long-term residual income.

Click here to watch a YouTube video on MA & PDP commissions 2025

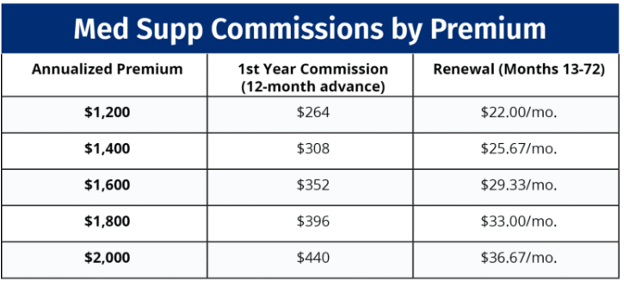

Example using 22% commission and 12-month advance:

For agents selling Medicare Supplement plans, commissions remain a steady and reliable income source. While initial-year payouts may be lower than Medicare Advantage, the ongoing renewal structure provides financial stability.

Join the team at Crowe- click here for online contract

Please note: These payment amounts vary by carrier and product. Not all carriers pay 22% for enrollments. This amount varies quite a bit. Be sure you check each carrier’s rate in the specific area you plan to market the plans in.

Recent Comments