How to compare Medicare supplements

It is important for Medicare insurance agents as well as Medicare enrollees to understand how to compare Medicare supplements. Medicare supplements (Medigap) insurance provides coverage to fill the gaps after Original Medicare pays its share of covered medical expenses.

Medicare supplement plans are standardized

Because CMS standardizes all Medicare supplement plans, they must provide the same benefits. It does not matter which company offers the plan or what state you live in. In many states, beneficiaries have a choice of ten different plan choices. The plans are named by the letters: A, B, C, D, F, G, K, L, M & N. Please note, plans with the same letter name only differ by price. Insurance companies decide the pricing of their plans based on letter name and coverage area.

To view the benefits for each plan, see the chart below

Medigap Benefit |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Plan A | Plan B | Plan C | Plan D | Plan F* | Plan G* | Plan K |

Plan L |

Plan M | Plan N | |

| Part A coinsurance & hospital costs up to 365 additional days after Medicare benefits are used | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Part B coinsurance or copayment |

Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes*** |

Blood (first 3 pints) |

Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled nursing facility coinsurance | X | X | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A deductible | X | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Part B deductible | X | X | Yes | X | Yes | X | X | X | X | X |

| Part B excess charge | X | X | X | X | Yes | Yes | X | X | X | X |

| Foreign travel exchange (up to plan limits) | X | X | 80% | 80% | 80% | 80% | X | X | 80% | 80% |

Out-of-pocket limit** |

N/A | N/A | N/A | N/A | N/A | N/A |

($7,060 in 2024) |

($3,530 in 2024) |

N/A | N/A |

Another fact to consider, *Some states offer a high deductible plan option for supplement Plans F and G.

To learn about Medicare high deductible Plan G, watch our quick video

Third, ** Medicare supplement plans K and L show how much they pay for approved services before you meet your annual out-of-pocket limit and Part B deductible. Once both are met, the plan pays 100% of approved medical expenses.

Last, ***Plan N pays 100% of the costs for Part B Medicare approved services. One thing to remember; this excludes copays for some office visits and some emergency room visits.

To learn more about Plan N, click here

Comparing Medicare supplement plans

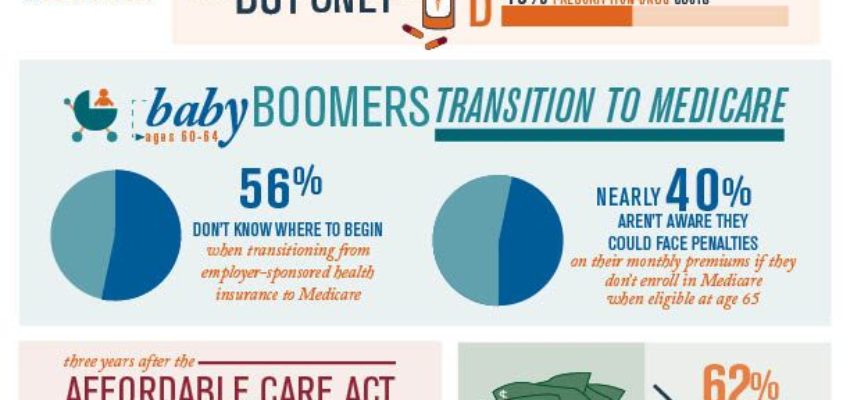

Before a Medicare beneficiary signs up for a Medicare supplement plan, it is important to consider your health care needs and your budget. When possible, future healthcare needs as well. Choosing the right plan can save you money as well as provide peace of mind.

Because the cost for plans varies so greatly, it is a good idea to work with a licensed Medicare agent who has access to the most competitive plans in your area. Licensed agents can provide a cost comparison and go over coverage details that you may not consider.

Find out the value of using a Medicare agent

Although friends and relatives are often a great help with many things, please remember, each individual has their own health care needs. What works for one person may not be good for another.

Consider the customer satisfaction record of each carrier

Additionally, in some instances, it may be worth a few extra dollars to have peace of mind and feel confident with your choice of insurance carriers.

Because health care coverage is such an important decision, beneficiaries need to consider all their needs and the options available.

If you want to join the team at Crowe and Associates, click here for online contract.

Recent Comments