Medicare Savings Program Connecticut

Crowe and Associates wants to help you sort through some of the information on the Medicare Savings Program Connecticut.

Medicare Savings Programs are designed to help Medicare recipients by paying the Part B costs for them. Although Part A is no cost to most people, if the recipient or their spouse has not worked long enough to qualify for this benefit then, the MSPs (Medicare Savings Program), may pay the Part A cost for you. MSP will also pay for the monthly part B premium which everyone pays for. Your income must be within a certain range in order to qualify for the MSP. There are 3 types of Medicare Savings Plans available, each one is based on the recipients income level.

The income limit amounts will remain in effect through March 2018. We have listed the three plans that are available below:

Medicare Savings Program Connecticut: First Plan:

QMB – This plan is for only people who qualify as Medicare Beneficiaries and meet the income criteria as stated below.

Qualified Medicare Beneficiaries (QMB) – There are no asset limits on this plan.

QMB income limits (211% FPL): If you are a single person with income of $2,120.55 or less per month.

If you are a Married couple with income of $2,854.83 or less per month.

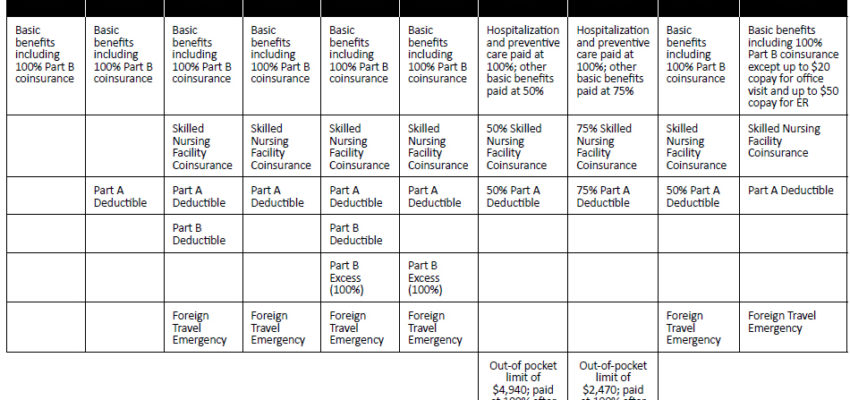

This plan pays not only premiums for Medicare Part A and Part B but also deductibles and co-insurances as well. It will also pay for drug plan premium up to the benchmark plan premium, provided coverage in the coverage gap and limit drug copay costs.

Medicare Savings Program Connecticut: Second Plan:

SLMB, this plan is solely for people who meet the following criteria:

SLMB or (Special Low Income Medicare Beneficiary) income limits: (231% FPL) – There are no asset limits on this paln.

If you are a single person with income of $2,321.55 of less per month.

If you are a married couple with income of $3,125.43 or less per month.

This Plan will pay only Medicare Part B premiums. It will also pay for drug plan premium up to the benchmark plan premium, provided coverage in the coverage gap and limit drug copay costs.

Medicare Savings Program Connecticut: Third Plan:

ALMB is also called the Q4. This plan has limited funds, therefore it is only available until the funds are exhausted. This is not an entitlement program and applications can only be accepted while there are funds available. ALMB, (Additional Low-Income Medicare Beneficiary) programs also have no asset limit

ALMB income limits (246% FPL):

If you are a single person with income of $2,72.30 or less per month.

If you are a married couple with income of $3,328.38 of less per month.

This Plan will pay only Medicare Part B premiums. It will also pay for drug plan premium up to the benchmark plan premium, provided coverage in the coverage gap and limit drug copay costs.

TO VIEW QMB vs MEDICADE COVERAGE CLICK HERE

If you would like more information about any of these programs please contact Edward Crowe at Crowe and Associates either by phone at (203)796-5403 or by email at Edward@croweandassociates.com.

Recent Comments