High Deductible Plan F

High Deductible Plan F can save substantial amounts of money on a yearly basis compared to a Medicare supplement plan F, G or N. The following description will detail how the plan works and why it is often a better option for seniors.

What is a high deductible plan F?

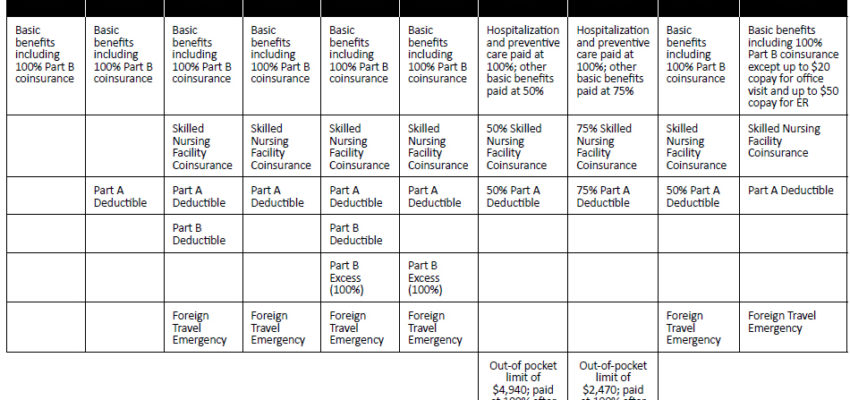

A high deductible plan F is a Medicare supplement plan (also called a Medigap plan). It has the same benefits as a standard plan F supplement but with a $2,200 deductible prior to having the coverage of a traditional plan F. Once the deductible is satisfied, the high deductible F covers exactly the same as a plan F. The benefit of the high F is the reduced monthly premium which can be up to 80% lower than the standard plan F premium. Because high F is a standardized supplement, there is no provider network. Medicare supplements do not have networks. You may go to any doctor that accepts Original Medicare.

How does the deductible work?

The high deductible Plan F deductible does not work the same as a traditional high deductible plan. Medicare A and B roughly covers 80% of approved services. The 20% left over is the only amount that goes toward the deductible. The common misconception is the insured needs to pay the first $2,200 of services which is not the case. In fact, most people enrolled in the high F plan do not meet the deductible on an annual basis. The key is to understand what Medicare A and B covers which will provide a better understanding of what charges will go toward the high F deductible.

How much money can be saved on a high F plan?

The savings is in the reduced premium. There is also additional savings when the annual deductible is not met. Premiums vary by state. We will use Connecticut as an example. In Connecticut, one of the lower cost plan F supplements is $239 a month. One of the lowest cost high F plans in Connecticut is $53 a month which creates a substantial savings.

Plan F premium = $239 a month x 12 months = $2,868 annual premium. This premium will be paid regardless of how often the plan is used.

High deductible plan F = $53 a month x 12 months = $636 annual premium. This is a difference in annual premium of $2,232. In the event the full deductible was hit for the year, the total plan cost would be $2,836 ($636 annual premium + $2,200 deductible paid). When the deductible is met, the annual savings is marginal but the deductible is not often met for the year.

How often does the average person meet the $2,200 deductible?

The high deductible plan F works so well because the deductible is not often maxed out. Here are some national averages to consider.

85% of people age 65 to 67 spend $541 a year toward the $2,200 deductible. Remember that Medicare A and B is providing coverage at 80% of Medicare allowable charges and only 20% goes toward the deductible. As a result, this will provide a total annual savings of $1,691 using the high F plan vs. the standard F plan.

80% of people age 68-72 spend $647 a year toward the $2,200 deductible. This would be a savings of $1,585 using the high F vs. the standard F plan

70% of people age 73+ spend $754 a year toward the $2,200 deductible creating a savings of $1,478 a year.

Those that do manage to spend $2,200 for the year will be no worse off than if they had a regular plan F. Maxing the deductible plus the annual premium still has them spending less than the total annual cost for a standard plan F. The benefits are the same once the deductible is met for the year.

What happens if I meet the $2,200 deductible for the year?

If you do meet the $2,200 deductible for the year, your plan will pay all Medicare approved claims. It will work just like a regular plan F. The insurance carrier will track all costs and will pay your claims automatically if you have accumulated costs up to $2,200. Everything is automated, without the need to submit any type of paperwork. Note: Please be sure to use a carrier that provides automatic claims filing. Using a carrier that does not auto file claims may require you to submit paper forms for claims to be paid.

What if I decide I want to go back to my old supplement?

In CT, NY and some other states, you are allowed to change supplements the 1st of any month the entire year. If you try the high deductible plan F and don’t like it, you can change back to your old plan F, G or N any month you like. The change is guaranteed and can not be blocked due to health conditions in guaranteed issue states. The process to change back is quick and simple.

Next steps

Call our office to discuss further at 203-796-5403 or email Edward@croweandassociates.com

CLICK FOR MORE DETAILS ON MEDIGAP HIGH F PLAN

Recent Comments