Medicare Plan Choices Connecticut 2017

Medicare plan choices connecticut 2017 will cover Medicare Advantage (Also called Managed Medicare or Medicare part C, Medicare Supplments (also called Medigap) and Medicare Part D plans. Various companies in Connecticut offer all three types of plans for 2017. This post will cover all three plan types. Also it will cover how a Medicare receipient can pick the best choice for him/her. Benefit and rate comparisons have been provided below throughout the post. Good luck.

NOTE: There are links below which provide Medicare supplement, Medicare Advantage and PDP plan comparisons for the State of CT. We can run any additional quotes/comparisons that are needed for any product. (MAPD, Medigap, PDP) Call or email our office with any questions (203)-796-5403 or email Edward@croweandassociates.com.

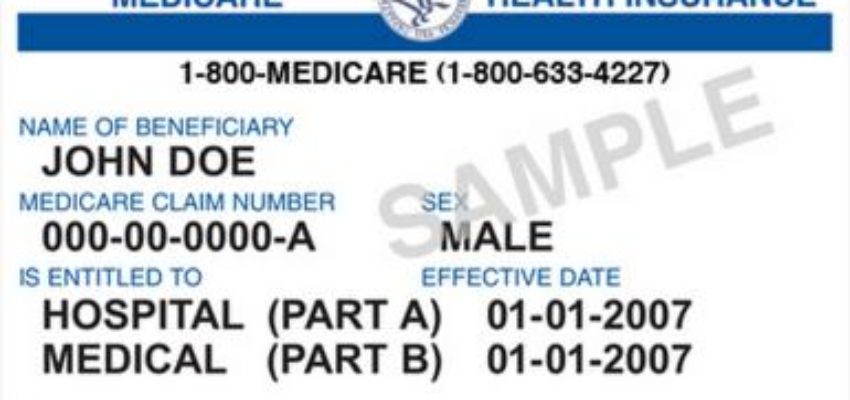

Quick Medicare A and B Information before getting into the plans

First of all, you need to know the basics rules of Medicare A and B. While picking the right plan is important, having Medicare A and B is probably as important. First of all, you must have Medicare A and B to enroll in a Medicare Advantage plan (MAPD) or a Medicare suplement plan (Medigap). A part D drug plan (PDP) requires you to have Medicare part A and/or B. Medicare part A cost nothing for almost everyone while part B costs money every month. CLICK FOR PART B PREMIUMS If you are drawing social security already, the part B premium will be taken out of your check every month. If you are not drawing social security, you will be billed quarterly.

Part A of Medicare covers hospitalization while part B covers outpatient services such as doctors and testing. CLICK FOR MEDICARE A AND B BENEFITS You will see that Medicare covers 80% of Medical costs, as a result, most people want to cover some or all of the other 20%. Finally, it does not cover prescriptions drugs, therefore many people purchase a PDP plan. As a result, those aging into Medicare likely will enrol in a Medicare Advantage plan or a Medigap and/or a PDP plan.

Medicare Plan Choices Connecticut 2017- Medicare Supplements (Medigap Plans)

Medicare Plan Choices Connecticut 2017

A Medicare Supplement Insurance (Medigap) policy, can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like foreign travel coverage. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare allowed amounts for covered health care costs. Then the Medigap pays its portion of the cost depending on the plan you have.

A Medigap policy is not a Medicare Advantge Plan.

Things to know about Medigap policies

- You must have Original Medicare A and B

- If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

- You pay the Medigap premium and the Medicare Part B premium

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you’ll each have to buy separate policies.

- You can buy a Medigap policy from any insurance company that’s licensed in your state to sell one.

- Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you pay the premium. Furthermore, Connecticut is a guaranteed issue state for Medigap. This allow a change form one Medigap to another throughout the year without any health underwriting.

Medigap policies don’t cover everything

Medigap policies generally don’t cover benefits such as long term care, vision and dental.

Click for Medigap rates Connecticut 2017

Dropping your Medigap and Part D Prescription Drug Coverage:

You have to pay a Part D late enrollment penalty when you join a new Medicare drug plan if:

- Either you drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage, or

- You go 63 days or more in a row before your new Medicare drug coverage begins

Call or email us with any questions at 203-796-5403 or email Edward@croweandassociates.com. We do not charge a fee for our services.

Medicare Plan Choices Connecticut 2017-Medicare Advantage Plans

Medicare Advantage plans are sometimes referred to as Medicare Part C or Managed Medicare plans . They are Medicare-approved health insurance plans for individuals who are enrolled in Original Medicare, Part A and Part B. When you join a Medicare Advantage plan, you are still in the Medicare program and must continue paying your Part B premium. Original Medicare is not billed while in an Advantage plan, as a result, some people incorrectly think they are not part of the Medicare Program

Medicare Advantage plans provide all of your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) coverage. Sometimes, they offer additional benefits, such as vision, dental, and hearing, and most include prescription drug coverage. These plans often have networks, which mean you may have to see certain doctors and go to certain hospitals in the plan’s network to get care.

Medicare Advantage plans may potentially save you money vs using a Medigap and PDP plan because the monthly premium is much lower in most cases. Pricing (monthly premium, copays, dedutibles and co-insurance) will vary by plan provider, so it’s worthwhile to compare all plans in your area. Your costs will vary by the services you use and the type of plan you purchase.

Medicare Plan Choices Connectict 2017- Plan options can include:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS) (Not currently available in CT for 2017)

- Special Needs Plans (SNPs)

- HMO Point-of-Service (HMOPOS)

- Medical Savings Account (MSA) (Not currently available in CT for 2017)

You can generally join if you:

live in the service area of the plan you want to join (Most plans in CT are offered in all CT counties with a few exceptions)

- have Original Medicare, Part A and Part B, coverage.

- don’t have end-stage renal disease (permanent kidney failure requiring dialysis or a kidney transplant); however, there are a few exceptions.

Choose your plan carefully. Outside of when you first become eligible to enroll and other personal circumstances that may qualify you for a Special Election Period, you are only able to change plans once a year during the Annual Election Period. The Annual Election Period lasts from October 15 through December 7 of each year. (An exception to this rule is for those that have a “Trial Right” which allows them to change from an advantage plan back to a Medigap and drug plan.

There is also a Medicare Advantage Disenrollment Period, which runs from January 1 through February 14. During this time, individuals enrolled in a Medicare Advantage plan can disenroll from their plan and return to Original Medicare coverage and buy a Medigap and PDP plan if they want to.

One more thing to note is that Medicare Advantage plans, with or without prescription drug coverage, vary depending on where you live. The name of this blog is Medicare plan choices Connecticut 2017. In fact, the rules above apply to most states.

Medicare plan choices Connecticut 2017 – Click Here For 2017 MAPD Plan Comparison CT

Medicare Part D (PDP) Plans CT 2017

A prescription drug plan (PDP) is an option for those eligible that want to enroll in the Medicare Part D prescription drug coverage, which can lower the costs of prescription drugs for insured. A prescription drug plan (PDP) is a stand-alone plan, covering only prescription drugs. Enrollees who choose the option of prescription drug coverage through a Medicare Advantage plan would also have coverage for other medical expenses as part of that plan. Medicare Advantage drug plans and stand alone PDP plans are different but the drug coverage portion works in a similary manner. Enrollees pay a co-pay for each prescription, a monthly premium (not with some advantge plans however) and an annual deductible.

Note: Please call or email our office for a full list of PDP plans available in CT

Recent Comments