Medicare Eligible Employees

Medicare eligible employees on an under 65 group/employer health plan have options. They can either stay on the group health plan or they can sign up for Medicare part B and enroll in a Medicare supplement plan or Advantage plan. There are some variables to consider when making this decision.

How many employees does the group have?

If a group is under 20 employees, Medicare will be the primary insurance for those 65 and older. As a result, it usually makes sense for the employee to sign up for Medicare part B. Even those with coverage from the employer and are actively working. If they do not have part B, they could have next to no coverage at all given Medicare will be billed first.

If the employer group is over 20 employees, Medicare is secondary for the 65 and older employees. Employees that are working and receiving coverage from the group do not and should not always sign up for Medicare part B. Those that have coverage through work and are actively working will not be penalized for signing up with part B at an older age when they retire. When they do decide to retire or come off group coverage, they can then sign up for part B using a special election to do so.

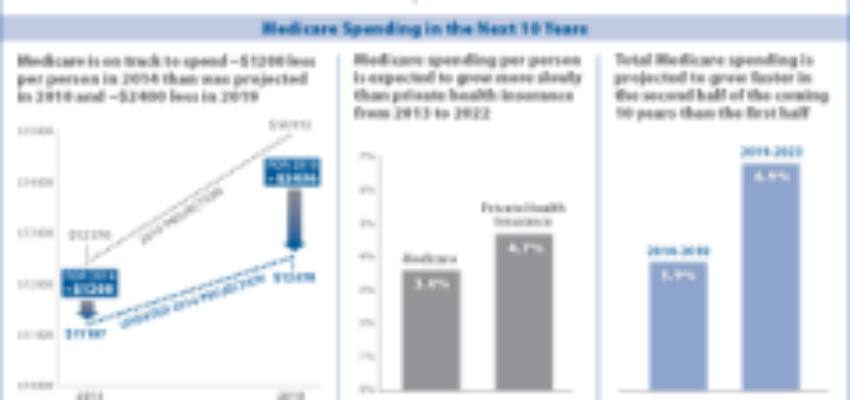

How the employer can save money

There is a big opportunity for employers to save money when it come to Medicare eligible employees actively working. The average Medicare eligible employee on the under 65 group health plan will cost about $1,500 a month in premium. Those employees can enroll in a Medicare plan with a high level of coverage for a much lower amount. As of 2017 , the Medicare part B premium for the average Medicare eligible person is $134 a month. The best Medicare supplement available is a Medicare Supplement plan F. The cost for plan F runs between $180 to $240 a month depending on the state. The average drug plan cost between $25 to $55 a month. The math obviously is better when using Medicare vs. group coverage. $1,500 a month vs $429 a month ($134 + $240 +55)

How does Medicare, a plan F supplement and a drug plan compare to the under 65 group health plan?

Part of the answer depends on the group health plan in place but in general the Medicare coverage will be superior with some notable exceptions. A Medicare supplement plan F covers 100% of Medicare approved services not covered in full by Medicare A and B. In other words, the coverage leaves the employee with virtually no medical expenses out of their pocket. When compared to a group health plan, the medical benefits substantially better. Medicare also does not require referrals and does not have a provider network. The Medicare recipient can go to any medical provider that accepts Original Medicare A and B.

Drug coverage can be a disadvantage. Standard Medicare Part D drug plans may have higher copays for name brand prescription drugs than the person would pay using a group insurance drug plan. For higher utilizers the Medicare part D coverage gap may also come into plan which can create additional out of pocket. In general, the employee that is utilizing generic drugs instead of name brand drugs will not see a noticable difference between the plans.

Saving money by moving Medicare eligible employees off the group plan and on Medicare

Obviously, there is big savings having an employee on Medicare instead of the group plan. Employers can pay the employees Medicare Part B premium, Medicare supplement plan F premium and stand alone Medicare Part D Rx premium and still save substantial money every month. This arrangement works in the employees favor as well because they will have a high level of Medical coverage and will not be paying any premiums.

While this set up will save money, employers may not discriminate against employees due to age. The employee must choose to voluntarily disenroll from the group plan and enroll in into Medicare. The employer would need be willing to state in an employee handbook the options employees that are 65 and over have. That means they can continue on the group plan or if they make the choice to disenroll from the group plan the employer will pay Medicare the Medicare Part B premium, Medicare Part D and Medicare Supplement premiums. It will often be financially more affordable for the employee to be covered by Medicare, a Medicare supplement and Medicare Part D plan than staying on the group plan. The employer is financially assisting the employee with the cost but it must be their choice to use this strategy.

How should the employer reimburse the premium?

Employers need to take care with how they pay the Medicare costs for the employee. In the past, it made sense to use a Section 105 plan to reimburse the premiums on a monthly basis. Due to new legislation and compliance a 105 plan is no longer a viable option. Some employers may choose to offset the premium cost by increasing the employees pay. This is a simple strategy but does create some extra costs. The employer pays approximately 10% to 15% in additional costs (FICA, Social Security, Workers Compensation, possibly payroll administrative costs) on the extra money. The employee is also taxed on the money they receive. Even with the extra costs, the total costs to both employer and employee will still be lower than if they stayed on the group plan.

Use a Small Business HRA

The Small Business HRA is a compliant way to reimburse premium without the additional costs. The only drawback is the arrangement is only available to groups with fewer than 50 employees. With a Small Business HRA, employees purchase Medicare Part B, Medicare Supplement plan and Rx plan independent of the company. The company then reimburses each employee tax-free for their premium costs up to a set monthly allowance. There are some notable requirements for a Small Business HRA….

- A company’s annual contributions are capped at $4,950 for a single employee and $10,000 for an employee with a family. HRAs use 100% company funds, employee do not make contributions.

- Employees with a Small Business HRA are required to have minimum essential coverage to receive HRA reimbursements.

- Generally, a company must make the same HRA contributions for all eligible employees. However, amounts may be vary due to family status.

Summary for employers

Having Medicare eligible employees can add up to huge savings for employers and employees alike. Employers must be sure not to discriminate based on age and as a result, Medicare eligible employees must make a voluntary decision to move off the group plan. Those with less than 50 employees can utilize the new Small Business HRA (Can be used as of 1-1-17) to reimburse the employees in a cost effective manner. Employers over 50 eligible employees can not use the HRA and only have the option of adding the additional money to the employees pay to offset the costs.

Additional questions?- Call our office at 203-796-5403 or email Ed Crowe Edward@croweandassociates.com

Click below for power point presentation on how employers can save money on their Medicare eligible employees.

Leave a Comment