Medicare Advantage commissions 2019

CMS has now published the Medicare Advantage commissions 2019. Read below to see how much commission you can receive for a Medicare Advantage plan (MA and MAPD) in your state. Remember, the commissions below are the max that CMS allows a carrier to pay. This does not mean all carriers will pay the max amount of commission.

CLICK HERE FOR UPDATED MA COMP 2023

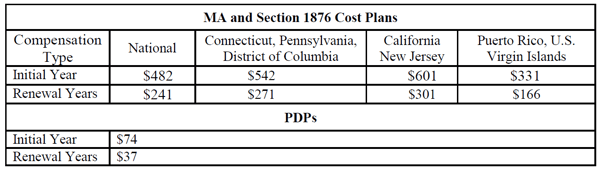

Great news, the Medicare advantage commissions for 2019 will increase. As a result, there will be a 5.9% increase ($27) for new Medicare Advantage plan applications. Agents will receive an increase of 5.7% ($13 more than last year) for Medicare Advantage plan renewals. Additionally, PDP plan commissions have also increased by 2.7%.

CMS sets max carriers can pay for Medicare Advantage plans every year. That gives the max amount of commission that a street level agent can receive. Additional compensation may be paid to those on a higher level contract such as GA, MGA, SGA, FMO or NMO contracts. (agency level contracts) Additional commission is available to agents who have a minimum required number of sub agents. In most cases a you must have a minimum amount of carrier specific production as well.

This notice provides the year 2019 compensation limits for sales agents, as well as independent and captive brokers.

Are you looking for Medicare Advantage comp for 2020? Click here for 2020 compensation

Medicare Advantage commissions 2019: Payment levels

Looking for 2018 commission levels? CLICK HERE FOR 2018 COMP LEVELS

The compensation amount independent agents/brokers receive for an enrollment may not be above the fair market value (FMV) limit amounts. The CMS (Center for Medicare and Medicaid Services) publishes these amounts annually.

The 2019 FMV Compensation for all states is listed below – Medicare Advantage Commissions 2019

QUESTIONS ABOUT MEDICARE ADVANTAGE COMMISSIONS 2019? Call Crowe and Associates at 203-796-5403.

Click here for agent contracting kit

If you would rather fill out an online contract; click here

Note: The rates referenced above are for agent use only. Some carriers may pay below the CMS compensation limits

Note: CMS also stipulates how brokers and agents receive commission pay. For a review of payment methods CLICK HERE TO WATCH A SHORT RECORDED WEBINAR

NOTE: The FMV amounts listed for 2019 are rounded off to the nearest dollar. The Initial Year amount is the maximum amount of compensation that CMS will allow as payment for enrollments during compensation cycle-year 1. The renewal amount is the maximum CMS allows as payment for enrollments during compensation cycle-years 2 and going forward. Some carriers will adjust the current renewal compensation that they pay on past sales to the maximum amount. Not all carriers will adjust current renewals to meet the max payment amounts.

Compensation Rate Submission for 2019- Medicare Advantage Commissions 2019

As in previous years, all sales organizations must inform CMS via HPMS if they use either employed, captive, or independent agents. Any agency or organization with independent agents must report the initial and renewal compensation amount paid to these agents. Additionally, if an organization pays any type of referral or administrative fees, they must disclose the fee amount.

Carriers, Agencies and other entities may submit their agent/broker information via the HPMS Marketing Module. You can submit this information from June 4, 2018 through July 27, 2018, 11:59 pm EST. Organizations that do not submit their broker compensation data by July 27, 2018 will be out of compliance with CMS rules and requirements. They are not able to make changes to those submissions after the July 27, 2018.

Medicare Advantage Commissions 2019- CMS required record keeping

All compensation information listed will be made available for the public to view on www.cms.gov prior to the start of the 2019 AEP. (October, 1 2019)

Medicare Advantage Commissions 2019 – Training and Testing Agents and Brokers for 2019

Regulations require agents and brokers who sell Medicare Advantage and part D products be trained, certified and tested annually. The training includes Medicare as well as plan specific information. Additionally, CMS requires anyone who offers or sells the products to receive a minimum score of 85% on such tests. These rules include employees, subcontractors, downstream entities as well as any other entities

CMS has measures in place to ensure the quality of all testing and training programs for agents and brokers. Each year CMS states all minimum testing levels as well as, the training needed for all entities.

Leave a Comment