Market Linked CDs and what they offer

This post will explain Market linked CDs and what they offer. Market linked CDs not only offer the protection of a traditional CD, but the security of being FDIC insured. In fact, these CDs allow for a more attractive rate of return versus a bank issued CD.

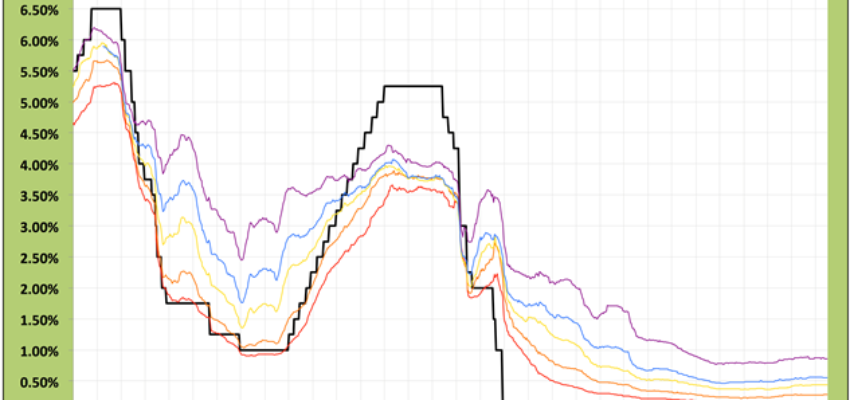

A market–linked CD (MLCD) is also referred to as either an equity-linked CD, market-indexed CD or simply an indexed CD as well. It is a specific type of certificate of deposit that is linked to the performance of one or more securities or market indexes, like the S&P 500.

Market linked CDs have an unlimited interest earning potential as variable interest can be unlimited (depending on the product). Not only do these CDs offer a return of 100% of the deposit at maturity, but they are also FDIC insured (at least $250,000 per bank). MLCDs pay the greater of either the fixed or the variable interest rates. They offer fixed interest rate products that pay a minimum of 1% annually.

Market lined CD issuers include JPMorgan, Barclays, Goldman Sachs and Bank of the West.

FOR MORE INVESTMENT INFORMATION CLICK HERE

MARCH 2015 RECOMMENDATION

- Goldman Sachs 7 Year Multi-Asset Index Linked CD

- At maturity this MLCD will pay 200% of the point to point MOBU index gains

- Best Case Scenario = 100% of your deposit back + unlimited upside potential

- $100,000 invested in this CD 7 years ago would be worth $186,800 today (12.40% APY)

- Worst Case Scenario = 100% of your deposit back

For more information regarding the sales of Market Linked CDs, please contact the office at 203-796-5403 or via email at admin@croweandassociates.com.

Leave a Comment