High Deductible Medicare Supplement

High Deductible Medicare Supplement is usually the best option for a Medigap plan if the premium is low enough. The biggest challenge is understanding how the plan works and why it will prove to be a better choice than standard supplements such as F, G and even N.

If you are willing to pay out of pocket for certain health care costs and if your state has a well priced high F plan it could be your best option. A high-deductible Medigap plan F can offer substantial premium savings while still providing dependable coverage. Premiums on high deductible Medicare supplement plan F can run up to 75% less than plan F and G supplements. As with any other supplement, high deductible Medicare supplement plan F still provides access to a huge number of providers because Medicare is still the primary insurance.

How does the High deductible Medicare supplement plan work?

We need to start with an understanding of how high deductible Medicare supplement plan F works. A high-deductible Medicare Supplement Plan F pays the same benefits as a standard medigap Plan F. Its the same only after the insured has satisfied a calendar year deductible. For 2017 the deductible is $2,200. In other words, the $2,200 represents the max out of pocket you pay prior to having full coverage just like a regular plan F.

Out-of-pocket expenses are those expenses not covered by Original Medicare. It is important to keep in mind the deductible is only for the expense that Medicare approves but does not pay all of. The insured does not pay the first $2,2,00 of medical services. You only pay the approved services that Medicare does not pay all of such as deductibles, copays and cost shares.

As an example, assume you have a Medicare eligible expense that costs $5,000 (Medicare approved amount which is usually much less than the provider charges.) Typically, Medicare will cover 80% of the approved charges which in this case is $4,000. This would leave the insured paying $1,000 of the charges. The $1,000 would then be put toward the $2,200 deductible of the high deductible Medicare supplement plan. As a result, there would be a potential to spend $1,200 more out of pocket for the calendar year. If there is another $1,200 of costs, the plan will cover 100% of the remaining Medicare approved services for the year.

Examples of how a high deductible Medicare supplement work using real premiums

Lets use a real example from NY. One of the lower cost high deductible Medicare supplement plans in NY cost $64.00 a month. $64.00 x 12 months is $768 in annual premium. If you max out the $2,200 for the year it will be a total cost of $2,968 for the year. One of the lower cost plan F supplements in NY (example is for the city, boroughs, Westchester county and LI) is $269.50 a month. For 12 months that would total up to $3,234 in annual premium. As you can see, the high F plan will be less even if the full deductible is met.

How much does the average senior spend toward the deductible in a year?

The big savings is when you do not meet the annual deductible. Here are some averages: 85% of seniors age 65 to 67 spend an average of $541 annually toward the deductible. 80% of seniors age 68 to 72 spend an average of $647 annually toward the deductible. 70% of seniors age 73+ spend an average of $754 a year. As a result, the averages favor the person enrolled in the high F plan saving substantial amounts of money every year. If someone does have a bad year and meets the deductible they will still save some money no matter what.

A high-deductible Plan F will almost always provide a savings for those enrolled in it vs. a plan F. The trick is understanding how the plan works. Also, being able to pay any larger sums that may occur early in the policy year. In some states, such as NY and CT, the insured can switch from one supplement to another. They can do this the first of any month throughout the year. Health underwriting is not allowed so you can not be blocked due to health conditions.

How much does Medicare A and B cover and how much will I be left to pay toward my deductible?

Medicare part A is the hospital inpatient part of coverage. There is a deductible for $1,316 for inpatient stays on part A. Part B is 80% coverage after the deductible of $183 (annual). Use the link to see other costs that will accumulate toward the deductible on A and B. Click for A and B benefits and cost share

Do you want to see the premiums for other Medicare supplements such as F,N,G,L and K?

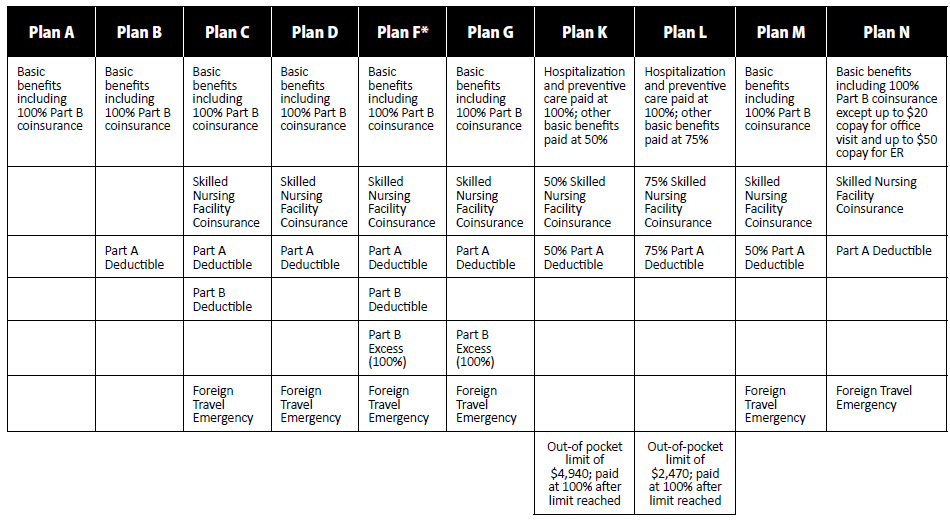

Benefits for supplements in most states are standardized by plan. This means the benefits are the same regardless of which company is offering it. For example, a plan F has the same benefits no matter who offers it. An example of rates is provided. We are using Connecticut Medicare Supplement rates as an example here. CLICK FOR CT MEDICARE SUPPLEMENT RATES